Intro note:

I’m going to do something unusual and re-release an edited version of the last post as a free one . I am going to leave the unedited (and pay protected) original in place for a week and then archive. My friend Dave played Jiminy Cricket and provides the “Top Comment” (a similar worthy comment comes in from Karan):

Dave: I think the ad hominem attacks in this piece reflect quite poorly on Michael honestly. He could have chosen to address the real discussion points without resorting to calling them ignorant, uninformed, lacking common sense, ill-read, etc. it’s one thing to argue ideas. He I’m sure would have been welcomed to TCAF or another media outlet to actually discuss. It’s another to just be a bully. (My opinion, as a paying subscriber)

MWG: I agree, Dave. I will confess that I am pissed off. The disrespect that the Ritholz team, especially Ben Carlson, has shown to those (not just me) who have put tremendous work into understanding how passive IS changing the market fundamentals is frustrating. And for the record, they have had plenty of opportunities to have me on as a guest to TCAF. It is not like I’m hard to find. I continue to believe that Upton Sinclair’s conclusion is accurate.

However, I am also wrong in how I presented my response. While I may disagree with them, I am not helping my cause with my own ad hominem (which, believe it or not, I edited liberally to remove even before posting). It is ultimately up to the heretic to make their case (“And yet it moves”) to the believer. To Ritholz’s credit, I have heard nothing from their camp.

We need to do a better job of assuming the charitable interpretation of others' actions, whether in the polling booth or Twitter. I can’t change society, but I can change myself.

Summary

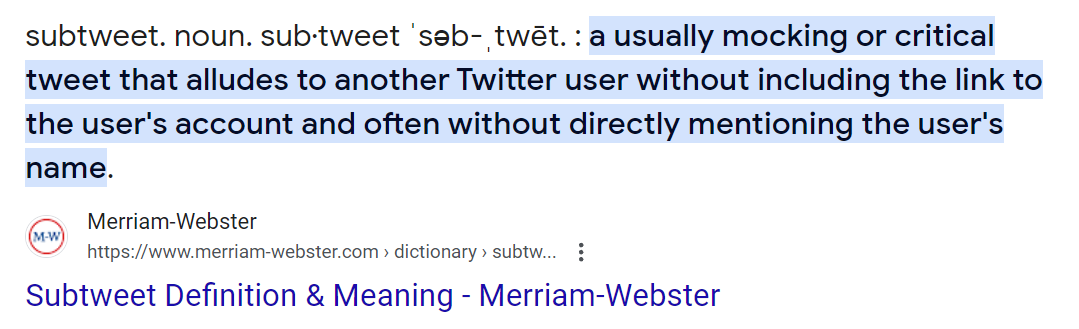

Subtweet and Industry Dynamics: A recent subtweet highlights the disarray among passive management proponents. I encourage them to do the work (links provided) and suggest that their attacks on active managers’ character deflects from their own conflicts of interest. They may disagree, but it’s worth considering.

Empirical Data and Theoretical Models: The prevailing models and empirical data used to defend the rise of passive investing seem compelling until we realize that they are riddled with inconsistencies. The decline in active management's alpha is not due to a lack of skill but rather external factors exacerbated by the proliferation of passive investment strategies. The paradox of increased underperformance by active managers despite lower fee differentials, suggests an external force at play.

Watch FX! The divergence between currency and interest rate volatilities, suggests potential systemic risks or mismatches in market perceptions versus actual economic indicators. Stability in FX has been generated by inappropriate rate policy across geographies, regardless of your personal views on Fed actions.

Reminder: Tuesday, March 26th is the quarterly YIGAF call for Institutional subscribers. I look forward to speaking with you! If you did not receive your invite, please let us know ASAP.

The Subtweet

This past week, one of the luminaries on fintwit posted a subtweet which was forwarded to me in several DMs.

Barry Ritholz’ interview of David Einhorn left passive proponents seeking ways to poke holes in the passive thesis. He put the question to Twitter rather than simply asking me:

The charitable interpretation is that Barry promoted the work of his employee, Ben Carlson. Assuming that to be the case, hopefully he’ll find the answers in this piece.

Barry’s skepticism is understandable because (like me) Ritholz Wealth Management has a dog in the fight. They are avid indexers. Per Whale Wisdom:

Ritholtz Wealth Management's largest holding is VANGUARD TOTAL STOCK MARKET INDEX FUND

Regular readers should know I have no objection to investors purchasing Vanguard’s products. They are cheap, well diversified, and functionally have little difference from other passive products. That they are engines of doom is not your personal responsibility. As I have noted repeatedly, “the music is still playing.” I DO have an objection to Vanguard’s lobbying, cult-like refusal to engage in discussions around the impact of passive investing, and complete unpreparedness for what will eventually occur when they are forced to sell. But those are stories for another day. For many registered investment advisors, passive products have been a lifesaver. Not only have they provided attractive returns, but they have also allowed RIAs to offer services at a competitive cost. Long gone are the days of commission compensation. Flat rate services are the story of the day, and as Eric Balchunas of Bloomberg has pointed out:

“Indexing needed Vanguard more than Vanguard needed indexing…. I think if Bogle hadn't existed index funds would be out but they'd be 80 - 90 basis points. They'd be used by institutions and fans of the efficient market hypothesis.”

I agree with this to an extent. Had Vanguard not adopted the mutual structure and continually shared the benefits of its share gain with its fund investors via lower fees, it is unlikely that indexing would have been adopted to the extent it has. More importantly, I don’t think it would have experienced the regulatory push of QDIA designation. From the Federal Register:

This document contains a final regulation that implements recent amendments to title I of the Employee Retirement Income Security Act of 1974 (ERISA) enacted as part of the Pension Protection Act of 2006, Public Law 109–280, under which a participant in a participant directed individual account pension plan will be deemed to have exercised control over assets in his or her account if, in the absence of investment directions from the participant, the plan invests in a qualified default investment alternative. A fiduciary of a plan that complies with this final regulation will not be liable for any loss, or by reason of any breach, that occurs as a result of such investments.

As I have said elsewhere, “Einstein was wrong. The most powerful force in the universe is not compound interest—it’s liability avoidance.”

As I have also noted, my models of “passive” investing suggest that there IS a benefit to market functioning from introducing heterogeneity into investment decisions. Markets benefit from the existence of participant who says, “If you give me cash, then buy. If you ask for cash, then sell.”

Back in 2017, I presented the following model of market volatility to Peter Thiel as part of the analysis underpinning the XIV trade:

My concern has always been about the impact that passive would have on underlying market volatility and the potential for an XIV-like event at the SPX level. As I developed my thesis, I traveled around the world (literally) meeting with the smartest investors I knew to share my thoughts. When I presented my analysis to the IMF’s Financial Stability Group, I was briefly heartened by their response — “We agree with your analysis.” And then crestfallen… “There is nothing we can do. Vanguard and Blackrock OWN the regulatory apparatus. If we raised the alarm, all we’d do is get fired. We have to wait for the event” And so I went out on my own to make certain that when the event occurred, this would not be a repeat of 2008 with the familiar refrain, “How could we have known?”

So to hear my concerns dismissed in the manner that Ben Carlson did really “pisses me off”:

“Many of the worries about indexing really boil down to career risk in the asset management space. By taking themselves out of the game and buying index funds, there are now fewer suckers at the poker table for the pros to take advantage of.”

Now it’s entirely possible that some asset managers are complaining about indexing because it removes the “suckers at the poker table.” And the evidence for this theory seems self-evident. Since fewer dentists in Peoria are speculating on stocks, if everyone buys the market in its totality, that should make the game harder as “less” money is available for active managers to generate alpha. A very simple model can be constructed:

Michael Maubisson promulgated this model in his writings on “Easy Games.” And it’s seductive with an element of truth. As the quantity of “Suckers” declines, the potential for alpha falls. But also note that the absolute “alpha” available to asset management should have grown due to the increase in assets, and the “burden” of asset management as a % of assets should have fallen with the decline in fees. The spread between “net” for active vs passive as a % of assets should have declined in this model:

All else equal, this should lead to a DECLINING share of active managers underperforming over time. This has generally been the hypothesis — passive will continue to gain share until a “tipping point” occurs and active managers are able to outperform by enough to offset their fees. But the opposite has happened — more asset managers are underperforming even as fee differentials have fallen sharply:

There are a couple of important points that we have to highlight in this conundrum.

The share of funds that underperform as measured by the intercept (62.95%) is impossibly high given the low level of fees. We can calculate the theoretical share of managers that should underperform given a level of alpha as % of active AUM and std dev amongst active managers. With almost ALL studies suggesting that active managers add alpha BEFORE fees, the observed outcomes are “impossible.” The actual data on manager standard deviation of returns and estimated alpha is highlighted in yellow:

2. The level of fees, especially net of load funds, has collapsed with a DECLINING share of managers outperforming after fees. This is not theoretically possible unless an outside force has lowered manager returns. And it turns out that others are waking up to this reality. Morningstar published a report in Q4-2023 that finally acknowledges the growth of passive management is harming the returns to active management and acknowledging the role of investor flows in determining return:

Note the very scary observation — “if current flow trend continues, the AUM of active mutual funds will drop to 17% of the total AUM of equity funds after 15 years.”

To be very clear, I do not think that passive is the ONLY thing that matters. In fact, part of the point of emphasizing “elasticity” is that it helps explain why stocks are far MORE sensitive to earnings reports. Increasingly, even the largest stocks behave like low float microcaps when fundamental information is released. Why? In part, because Vanguard (and Blackrock, etc) does not change their behavior on the release of this fundamental information or on the price change. Ironically, this can confusingly lead to claims of increased efficiency because “post earnings announcement drift” (PEAD) is reduced. Once the earnings have been reported, “the price is right” according to passive. Even if that price is +/- $200B from the day before. I discussed some of these dynamics in my April 2023 post, “The Rhythm of the Night.” In simple terms, the “market impact” of volume changes is rising rapidly:

Goldman highlighted this increasing volatility on fundamental events almost a decade ago and unfortunately it’s even more true today:

Wondering why META declined so much in 2022? Well, certainly, earnings played a role. But at the end of the day, it was largely a beta (elasticity) play:

The declining alpha is NOT a function of skill. In fact, we can recreate the declining alpha for “active” management by simply substituting strategies that are “short vol.” Here there is no question of “skill” and yet we can recreate the same pattern:

Now I know everybody wants to shout, “This is because implied vol is falling relative to realized vol as short vol becomes crowded!” Would be nice if true… but it’s not:

So while the SKILL model is seductive, the empirical data does not support it.

So with that out of the way, let’s try to answer Ben (and Barry’s) question:

“If all the money flowing into index funds is propping up stock prices, why are large caps growing even faster than small and mid-caps? Wouldn’t it be easier to push up the prices of the smaller companies?”

This is covered in Valentin Haddad’s 2021 paper, “How Competitive is the Stock Market?” The literature is clear, but as one of my colleagues points out (thanks, Eric):

“Midwits don’t read academic papers (I am in this category)”

Quoting Haddad:

“the full model exhibits a stronger negative relation between the size of a stock and its elasticity. Koijen and Yogo (2019) point out that large stocks tend to have more inelastic investors overall. Once we allow individual elasticities to respond to stock characteristics and the aggregate elasticity, the data reveals an additional source for this relation: the same investor behaves more inelastically for large stocks than small stocks” (page 35)

Or perhaps we can use chart to illustrate. Note the larger the market cap, the LESS elastic the stock:

This matches with the work of J.P. Bouchaud, who’s work on market impact highlights an important point — liquidity does NOT scale with market cap. The mismatch between the liquidity demanded by index funds trying to buy Microsoft at $3T in market cap and the available liquidity is what drives these outcomes.

Now I confess to both frustration and “being pissed.” To be fair, there have been extenuating circumstances. Over the past two years, I have made repeated attempts to engage with the Ritholz team. Until the Einhorn interview, none of them bothered to engage despite me knowing Barry personally. Only one person follows me on Twitter (Barry) despite repeated in-person and online interactions. For heaven’s sake, I’m scheduled to appear on Barry’s Bloomberg show on May 1st (I would understand if Barry cancels after this Substack makes the rounds). This substack has zero subscribers from Ritholz Wealth (fifteen less than Vanguard, btw).

Unfortunately, this is the state of the passive management proponent industry:

It is clear there is a concerted effort to toe the party line. For example, Michael Batnick of Ritholz during his Animal Spirits podcast with Ben Carlson, while noting the bizarre behavior of SuperMicro in the past few months said:

“I think it’s pretty hard to argue that index funds do not impact certain parts of the market.”

Followed by his discussion with Ben Carlson:

“I mean, obviously, I'm not. I'm not in the camp that index funds are like wildly distorting markets, or I'm not in like the ‘Broken Market Theory,’ so that's a good question.”

Why obviously? Seriously. Fine, I may be the dumbest man alive, but do you believe David Einhorn is an idiot? (Sorry, David, I know you’re reading). The answer, as always, derives from the brilliant Upton Sinclair:

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Hopefully Barry does not cancel my May 1st appearance. I have no doubt it will be frosty. He certainly has that right after my first post. However, the positive takeaway is that even the most ardent passive proponents (e.g. Larry Swedroe) are increasingly forced to acknowledge that passive is indeed having an impact. Now the questions become, “So what?” and “What should we do?”

I hope I’m up to the task.

A Mismatch of Epic Proportions

It’s tough to get me away from equity markets given my somewhat unique focus on passive impacts, but I wanted to take a moment to highlight a giant divergence in currrency vs rates. While headlines are filled with the “collapse of the US dollar,” markets are not behaving that way at all. In fact, currency vol has hit unprecedented lows with EMFX now trading INSIDE DM FX:

This is occurring even as China’s condition becomes increasingly tenuous AND India appears to be losing the battle on the rupee. Egypt just devalued, Mexico just cut rates, etc etc. In general, this is a byproduct of countries reacting to the Fed’s interest rate hikes to try to maintain currency stability. If you agree with me that US rate policy is too tight (you don’t have to), it must be WAY too tight for Switzerland (just to pick a random name) where YoY CPI was 1.2% (yes, you read that right). In fact, the mismatch between rate vol and FX vol is hitting levels that preceded MAJOR devaluation events:

China’s FX has begun to wobble and their population is rushing to buy gold like it’s the new iPhone in 2015. Shanghai gold is now trading at a premium to London and New York. This is not about inflation in the United States.

I strongly encourage readers to take a look at the work of Michael Kao (@urbankaoboy) on this topic. The dollar wrecking ball is back in action, imho.

I’ve arranged for a 33% discount for Michael’s substack. He writes less frequently than I do, but I find his thoughts always worth reading. If you’re interested in checking out his work, please use this code for the discount: https://www.urbankaoboy.com/ffffa920

Once again, I went on far too long. I’m now late for a family event, so I’m going to send without the traditional “Top Comment.”

Some of your best writing, thanks! I think you might be being a bit harsh on yourself given you’re justifiably pissed off as one of the few facing into the storm, but even more credit to you for doing so with equanimity

I still struggle with the overall conclusion on how to react to the impacts of passive. I agree with the entirety of your thesis that it is occurring but the implicit view in your thoughts is that we will have lost true price discovery and that this ends with limit down after limit down when flows reverse.

You haven't spoken at this anywhere that I can find, have looked pretty far and wide and have been following your thoughts on this since 2018. The only thing I can find is that you believe vol (upside calls) are systemically underpriced.

But why would I not go levered long (say 1.2x) large caps and just monitor unemployment data for the next 10 years, and then unlever, sell calls, and buy OTM puts as unemployment data starts to show increases? Is that not a simple way of practically playing your thesis?

Can you please provide some color on this? It's too theoretical right now without any practical steps for how to action it / protect oneself.

Like at the same time, I'm a bit worried about buying SPY and QQQ with my retirement funds based on your overall thesis. But it's not clear if I should be concerned in doing so.