Backwards History

Warnings, Wolves, and Winners

Quick Comment on Markets

Given this week's events, let me reiterate a point I made earlier: I am short-term bullish on bonds, bearish on equities. I provided receipts in the below tweet:

Of course, there’s a caveat. Seasonality in inflation is about to collide with the "limited inflation" narrative. September's report (released in October) is likely our last stretch of good news. After that, the risk is a replay of the "trapped Bernanke" dynamic of 2008 — inflation pressures alongside economic distress.

If the Fed cuts 25bps and reported inflation begins to rise, bond weakness may destroy collateral and unwind the post-June rally in junk credit. But as refinancing shifts mortgages to adjustables, net duration supply falls — setting up an eventual supercharged duration rally as demand rises and supply shrinks.

The Trap of Retrospective Certainty

History seduces us with inevitability. The signs, we tell ourselves, were obvious: Hitler, Mao, 2008, the Dotcom bubble.

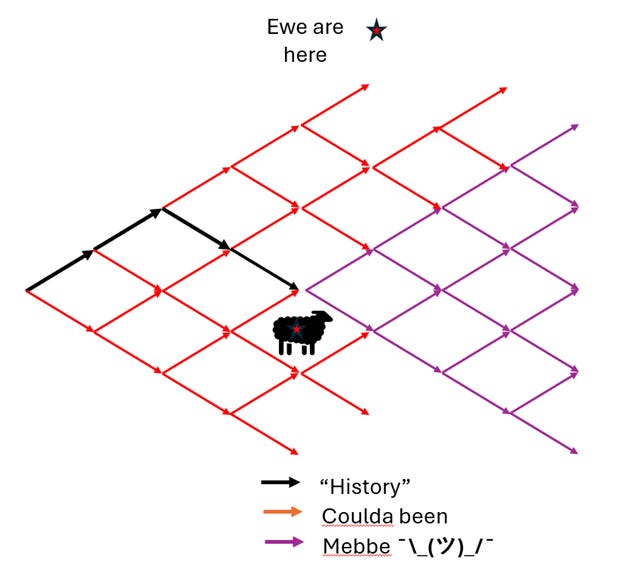

But that's backwards history — outcome first, cause second. It erases noise, blind alleys, and the real uncertainty of lived experience. It makes us punish early warnings and dismiss them as hysteria — until they become prophecy. And then we embrace the prophets and ignore the change in conditions that set the stage for the next rally. Rinse, repeat.

Finance people love to imagine "choices" as a neat binomial tree. Start here, branch there, Cox-Rubinstein, Black-Scholes. But what if the inputs are corrupted? What's unemployment if the BLS is broken? What's growth if accounting is fiction? We don't even know our starting point.

Weimar Germany and Mao's China: The Illusion of Inevitability

We tell simple stories:

Hitler rises in the 1920s, seizes power in 1933. The signs were clear.

Mao's Great Leap Forward morphs into the Cultural Revolution. The signs were clear.

Except they weren't.

Germany:

1919–20: Germany in chaos, dozens of militias fighting in streets. Hitler just another angry voice in the mob.

1923: Hitler attempts armed takeover in Munich, fails spectacularly, goes to prison. Looks finished.

Mid-1920s: Germany stabilizes. Economy recovers, culture thrives. Nazis shrink to 3% of vote, survive only in rural backwaters.

1930s: Depression, youth unemployment, Nazi surge. Then in 1932 they lose seats, look spent.

1933: Chancellor, Reichstag Fire, Enabling Act — dictatorship within months.

China:

1958-62: Great Leap Forward kills millions through famine. Mao's prestige shattered.

1962-65: Mao sidelined, pragmatists like Liu Shaoqi and Deng Xiaoping run the country. Recovery begins.

1965: Mao launches Socialist Education Movement. It fizzles.

1966: Mao mobilizes students against "capitalist roaders." Universities close, Red Guards form.

1966-69: Students destroy "old culture," purge millions. Country descends into near civil war.