Are You Not Entertained?

The growing madness in markets is a warning sign and Powell is now fighting a war on two fronts

Section 1: Market Dynamics and Passive Investment Trends

Market behavior is increasingly influenced by passive investment strategies, resulting in heightened price inelasticity and extreme market events, such as the December 8th momentum unwind and December 18th volatility during the Powell presser.

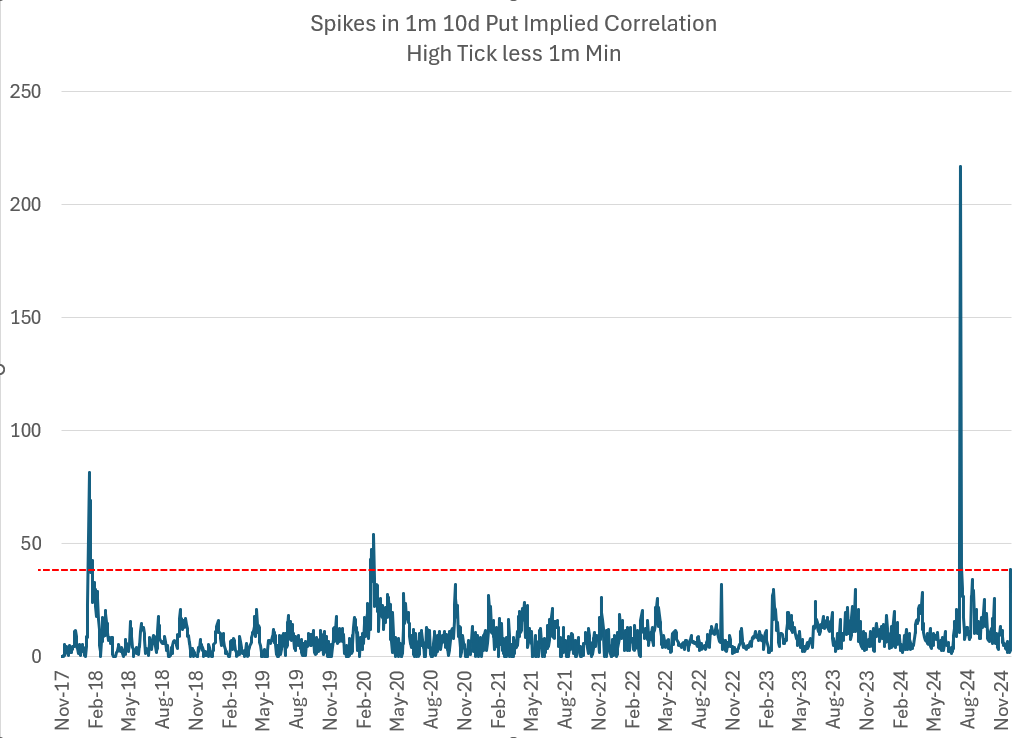

Structural changes, including the rise of short-dated options, have led to reduced implied correlations and disruptions in traditional volatility metrics. This is contributing to the extreme price volatility in the VIX.

Section 2: Powell’s Pivot on Inflation Metrics

Jerome Powell acknowledged the limitations of imputed price components in CPI, such as Owner's Equivalent Rent, and emphasized the importance of market-based measurements like new leases for assessing housing inflation. This is a first for a Fed chair to my knowledge.

Shifts in inflationary trends, driven by easy comparisons and skewed seasonality, point toward stable inflation expectations even as new entrants to the Fed are pushing an inflation narrative. Powell's concerns about labor market dynamics and structural revisions in data complicate the outlook for future rate cuts, but suggest he’s finally grasping the real issues. Predictably, market participants expect “more of the same” even as notable shifts are underway.

Brief Note

My apologies to readers for the skipped note. I was traveling for work across multiple time zones and latitudes (temperature gradient) and my immune system revolted on Saturday the 14th, leaving me bed-ridden in a Hawaii hotel room. I managed to pull off meetings in Hawaii with clients (keeping my distance) and a unique opportunity to meet with the Navy’s APAC command group, but little else. As punishment, the note is extra long this week. I’m taking a partial break from passive to discuss what I believe was a VERY important Powell pivot in part two of today’s note.

The Main Event(s)

Even as markets remain near all-time highs, we are seeing increasing evidence of the impact of passive investment strategies — namely a surge in “inelasticity”, large price movements on apparently small changes in volume. On December 8th, we saw one of the most violent unwinds in momentum over the last decade:

Followed by another extreme event on the December 18th Powell presser:

Sentiment indicators are off the charts on risky assets, suggesting the pool of buyers is growing increasingly slim:

The introduction of short-dated options has structurally shifted implied correlations as hedging increasingly moves to single-day events from the 30-day horizon, leaving the monthly options with little demand and large aggregate supply due to increased overwriting of index calls for income and dispersion trading. Implied correlation is running nearly 50% below levels that “comovement” (single stocks moving in same direction) would suggest:

This has facilitated the two separate VIX spikes in the past few months where implied correlation has soared to levels that exceeded and rivaled Volmaggedon.

And “Short VIX” in its XIV form (reintroduced as SVIX) has performed disastrously relative to long equity:

Unfortunately, as predicted by my theories of passive, “short vol” as a strategy has now underperformed “long equity” for the longest period on record. The data set is far too short for a definitive conclusion, but something does indeed appear different:

This has been accompanied by the most extreme breakdown in “factor” correlations in history: