Are we Asking too Little?

Strange patterns of distribution dominate the top stocks even as drift becomes increasingly pronounced. Are buybacks to blame?

Summary

A discussion of market conditions and the phenomenon of "under accumulation" or "under distribution" of securities, highlighting the different behaviors of SPY versus Vanguard ETFs.

We extend the analysis to the distribution patterns of leading stocks such as Nvidia, AAPL, MSFT, and Tesla, and raise questions about the impact of share buybacks on their deviation from expected behavior given accumulation/distribution. Research opportunity!

There has been an empirical shift in the distribution of returns over the past 26 years, with the median rising faster than the average, indicating a rightward drift. This drift suggests potential opportunities for buy and hold strategies and option strategies, but the R-squared value remains low, indicating that there is no conclusive proof to support this observation.

Top Comment

Peter Harris: “Seems like a generalized punchline here would be that owning the top-weighted, highest quality individual names in ETFs/indices with significant passive exposure likely creates overweight performance opportunities simply due to underlying mechanics outlined above [last week’s discussion]...

MWG: Agree. This observation contributes to the design of the equity long/short overlay in the Simplify High Yield Plus Credit Hedge strategy where we are deploying a high quality versus junk overlay. Quality benefits from passive on two fronts:

Because it suffers from less volatility drag, it obtains a more consistent bid from passive strategies than more volatile securities. Remember a stock that is up 5% and then down 5% is down 0.25% even though its arithmetic return is 0%. A 4x more volatile stock would be up 20% and then down 20%, leaving it down 4%. As a result, the next $1 into passive strategies would overweight the first stock even though they have identical arithmetic average returns.

Because high quality as a holistic measure is positively correlated with the high profitability needed to fund significant share buybacks, today’s note may provide an additional impetus.

Where I do NOT believe Quality benefits is from the inability to leverage (“people be stoopid”) argument of many of its proponents.

The Main Event

Yesterday was the start of the great-Green Migration… the roaming homeless, empty-nest Nomads piled into an RV with their two dogs and began a two-week journey across the great American expanse. House is sold, apparently just in time, as my realtor tells me house traffic has come to a dead stop in Marin County. My eldest, who plays a role in answering your YIGAF emails, has officially flown the coop and moved into his first apartment in the Washington, DC area before starting work. I will miss him terribly. The younger two are working in NYC and military bases unknown for the summer, respectively, before returning to finish their college careers. Being on the East Coast will make it much easier for episodic family reunions (and make my mornings a bit less hectic). It’s time for something completely different. Again.

Speaking of different, there has been a notable change in market conditions that candidly perplexes me. I’ll share some more definitive thoughts on the phenomenon, but I’d genuinely appreciate thoughts from the peanut gallery. Actually, since many of you have upgraded to paid (thank you for confirming I’m not shouting into the void), we’ll refer to it as the orchestra section.

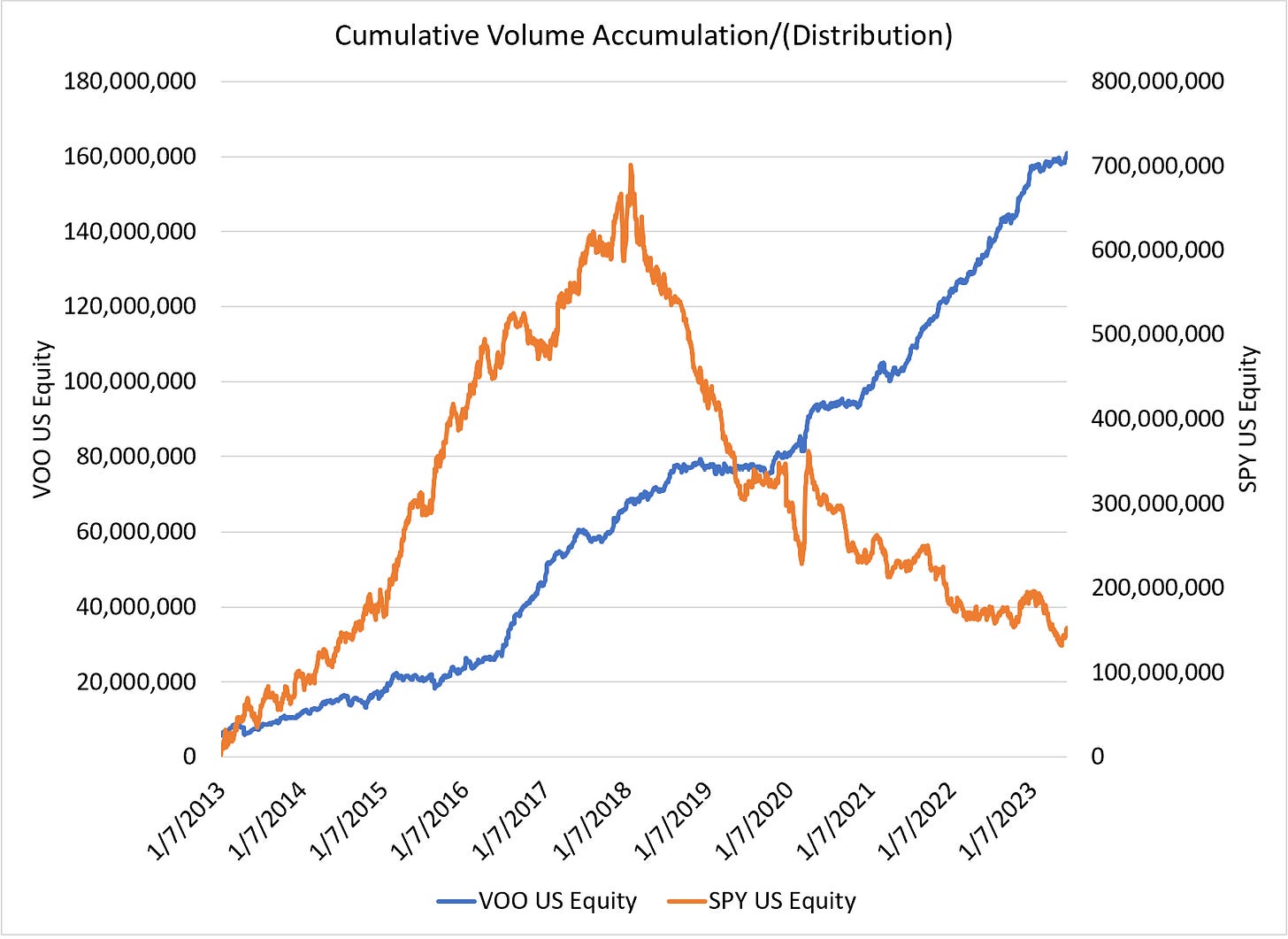

One of the terms you hear on Wall Street is “under accumulation” or “under distribution” which refers to a pattern of securities being “net bought” or sold. The traditional tools for identifying this phenomenon involve identifying whether shares trade hands at the bid or the ask. The underlying assumption is that shares purchased at a bid are being net sold; those purchased at the ask represent a motivated buyer and hence accumulation. One of the reasons I have tracked this metric has been to provide additional color to the passive share gain story. Even within the passive story, there are different actors. For example, the otherwise identical SPY (the trader’s S&P500 ETF) and VOO (the buy & hold investor S&P500 ETF) have materially different behavior when measured against the “bid” and “ask.” SPY trades almost exactly 50/50 bid vs ask while the Vanguard product, unsurprisingly is under nearly constant accumulation:

Ignoring for a moment the obvious conclusion that Vanguard customers, by continuously executing at the ask, are paying a premium for their shares that is not properly reflected in the “costs” of Vanguard management, this also suggests that net buying from Vanguard almost certainly contributes more to index market prices rising on a structural basis than SPY trading. And in fact, since Volmaggedon (Feb 5, 2018), we have seen SPY in cumulative distribution while VOO has been under nearly continuous accumulation. Trading is a dying business while buy & hold passive has been where it’s at: