An Open Letter

Can we use AI to get Warren's attention? Let's see!

Before we get to the “main event,” I wanted to refresh a post-election observation.

From November 10th:

“While this may sound absurd in the context of a fractious campaign season, as a reminder my primary fear was a reemergence of the #RESIST mentality. The depths of the Democrats’ defeat seems to have sunk in, and while it is far too early to tell we have not yet seen an explosion of #RESIST in the public domain. While Google trends projects it, the data is simply too sparse to tell at this point”

Well, it is no longer “too sparse to tell,” but it took an unexpected form — the “Tesla Takedown” has exploded onto the scene in a manner that far exceeds the #RESIST movement from 2016:

Like many of my readers, I am concerned about the abuse of executive branch authority. Like many readers, I am concerned about the bureaucratic barriers to accomplishing executive branch objectives. These concerns are occasionally at odds. Unfortunately, what I am much more concerned about is the fracturing of our society. Torching Teslas and Tesla dealerships is not the right path. I’m not sure how we de-escalate, which unfortunately suggests that we escalate. The risk to Trump’s “blitzkrieg” approach, regardless of your view of the policies themselves, is that he finds himself bogged down under persistent attacks while his supply lines are extended. It appears the opposition is gathering its forces, and perhaps it’s impossible to reach a negotiated outcome given the personal animus. If that’s the case, expect things to turn much, much worse.

In a similar vein, my caution on trade and tariffs has ALWAYS been about the risk of response and escalation. This week saw oppositional forces gaining strength there as well — in language at least. National pride is rapidly replacing economic rationality:

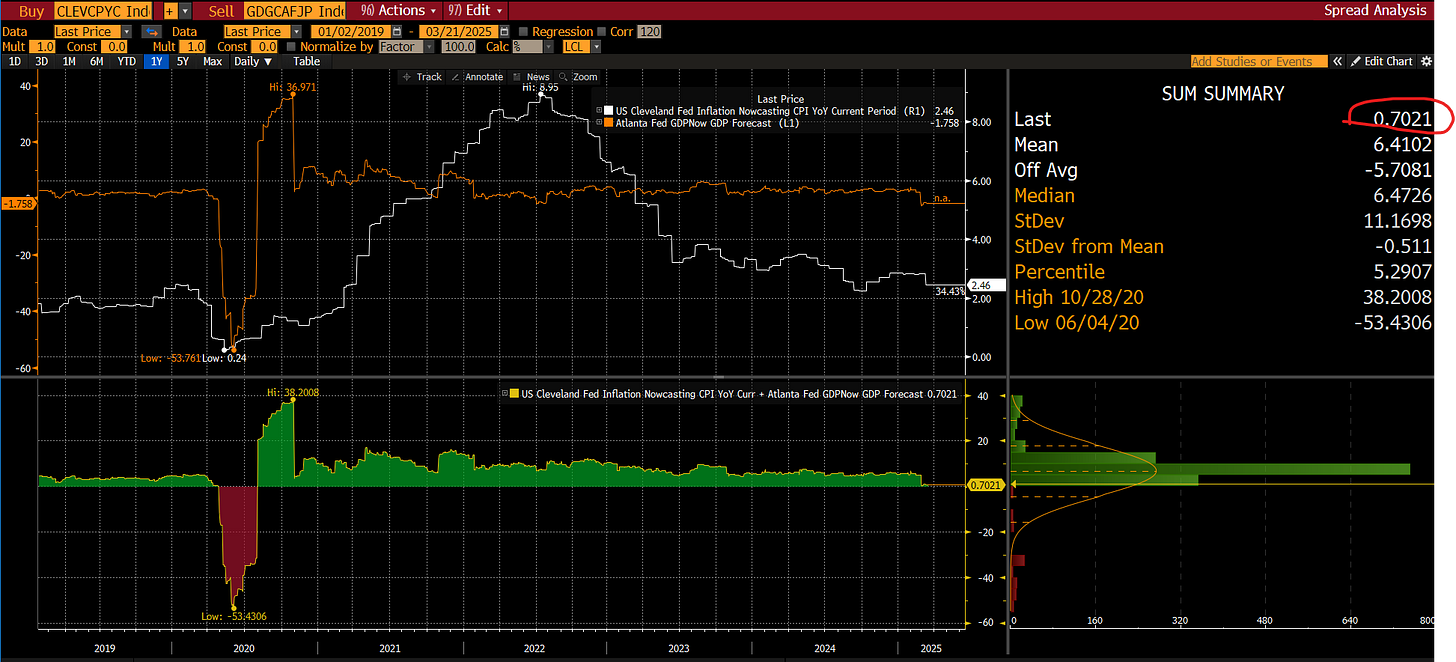

Unfortunately, the world is looking increasingly pear-shaped, with market participants expressing a general sense of disempowerment — “Is today the day the tariffs become reality? What about now?” — much like they did in the early stages of Covid. Investors, particularly retail, are largely dismissing the disruptions shown by the Atlanta Fed GDPNow (which has turned negative) and signals from the Cleveland Fed’s “CPI Now” which suggests inflation remains quiescent. The combination of the two suggests NOMINAL GDP growth at only 0.7% — nearly 3 std deviations below the posted levels we’ve averaged since the Covid reopening:

So, while I believe there is the potential for markets to rally through the end of the month as the option resets on Friday (quad witching) and for the end of the month (the infamous JPM hedged equity option) will likely increase risk-taking capacity, I am very skeptical about a return to 2023-24 bull markets. Eventually, the slowdown will matter.

And with that, let’s introduce a few more pages from the book. This is another “fun” chapter — an open letter from Warren Buffett mirroring his prior 1982 letter to Rep. John Dingell on the introduction of S&P futures. The point of this full chapter (which will be included next week) is to explore the Oracle of Omaha’s encouragement of passive investing in the context of today’s market rather than 1993. As you might guess, ChatGPT played an important role in fleshing out Buffett’s likely position. Try as I might, I simply could not get the AI to be more harsh. In my view, this suggests the output is likely correct.

For a fun diversion, I also used AI to build a “Dream Podcast Debate” along the lines of the IQ2 debates featuring myself & Howard Marks debating John Bogle and Warren Buffett. I’d love feedback if you get time to listen!

Why the sudden fixation on Buffett? Because my work has managed to catch the attention of attendees at the “Woodstock for Capitalists” event in early May. At the request of Guy Spier of Aquamarine Fund, a Buffett acolyte, I will be joining the VALUEx BRK 2025 event in Omaha on Friday, May 2nd. You can watch last year’s event here. My speech will be short and designed to get Buffetteers to consider whether Mr. Buffett has properly considered his articulated support for passive investing and the implications of the increased share. I’ll be posting the full chapter next week. In the meantime, I’ll be sending the letter to Mr. Buffett. Let’s see if he responds!

And with that, “An Open Letter”:

Subchapter 10:

An Open Letter on Index Investing, Stewardship, and the Responsibilities of Ownership

By Warren E. Buffett