A Test of First Rate Intelligence at Lake Wobegon

Bear with me... it's the part at the end you don't want to miss

Summary:

Is "Short Vol" setting up for another "Volmaggedon"? Unlikely. The impacts of regulatory changes on financial markets illustrate how market dynamics and risk assessments evolve with regulatory environments and market participants' strategies, emphasizing the need for a deep understanding of underlying market structures rather than a surface level finger-pointing

Shoddy data quality in prominent datasets like Fama-French underscores the challenges in relying on historical data for making forward-looking investment decisions, and calls for rigorous scrutiny of data sources and methodologies in financial analysis. We know nothing anymore.

Data is finally emerging that supports my year-long crusade to raise awareness of flawed employment data, rising credit card charge-offs, increasing non-mortgage personal interest outlays, and the decreasing disposable income of median households. These insights suggest underlying vulnerabilities in the economy that may not be fully reflected in surface-level metrics

Top Comment

First time commenter, long time reader Matt D in with the win:

Unfortunately the only way to normalize things is for asset prices to materially decline (maybe with a large steepening of the long end) and people to subsequently lose their jobs (both will mitigate passive flows into equities). Otherwise, we are just going to keep inflating this cap-ex bubble around whatever narrative is convenient. Nothing changes human behavior like a big drop in asset prices. We need a reset just not sure we get one. We had a chance last fall until Janet provided more stealth QE with her bill issuance

MWG: I largely agree, although I have shared elsewhere why I think both Janet and Jerome were less important than the simple decline in duration of bond indices (higher yield, lower duration) and an increasingly narrow market. NVDA is “no longer” being powered by total market flows, it’s increasingly about money into tech funds. 1999 redux. On this front, I’d argue the amazing flows into Bitcoin ETFs are finally beginning to distract from our broad passive enthusiasm. Ironically, it also speeds up the conclusion if so.

What I’m Reading Now

Once again, listening. I have spent a lot of time writing and thinking about the AI revolution and couldn’t agree more with Demetri Kofinas’ recent guest, Joshua Shrei, that we need to dust off the old myths in our consideration of these events. We are rapidly moving to a world that is largely indistinguishable from magic. The expectations of wizards and demi-gods in the context of their interaction with mere mortals may be the right model.

A Note from Our Sponsors

While I regularly speak to industry groups, only rarely do I show up at venues open to the general public. But in April, before all you loyal citizens pay your taxes, I’ll speak at The MoneyShow “Investment Masters Symposium” in Miami on April 10-12th. I’m looking forward to seeing some of my readers there. I’ll be speaking on both crypto and sharing my “Greatest Story Ever Sold” presentation. If you’d like to join me, please use the link to register. I believe tickets are on sale to celebrate St. Patrick’s Day.

The Main Event

The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.” — F. Scott Fitzgerald

"That's the news from Lake Wobegon, where all the women are strong, all the men are good-looking, and all the children are above average." — Garrison Keilor

My inbox has been burning up with reporters looking for commentary on the “Short Vol” trade. “It’s just like Volmaggedon!” is the repeated refrain. No, it’s not. Below is the key chart investors should have understood as we waded through the low vol environment of 2017 into 2018. The “beta” of the UX (VIX) futures had risen markedly versus the S&P500 as more and more risk was expressed as “short vol” rather than “long equities.” This was especially true for foreign banks. That changed on Feb 1, 2018, when the Fed included several new banks into the CCAR provisions:

In plain English, it became much more expensive for banks like XIV sponsor Credit Suisse to hold short vol positions. Hilarity ensued.

So is the “short vol” complex a risk? Of course. It’s always a risk when insurance is sold. Is it Volmaggedon? Not that I can see.

I Know Nothing

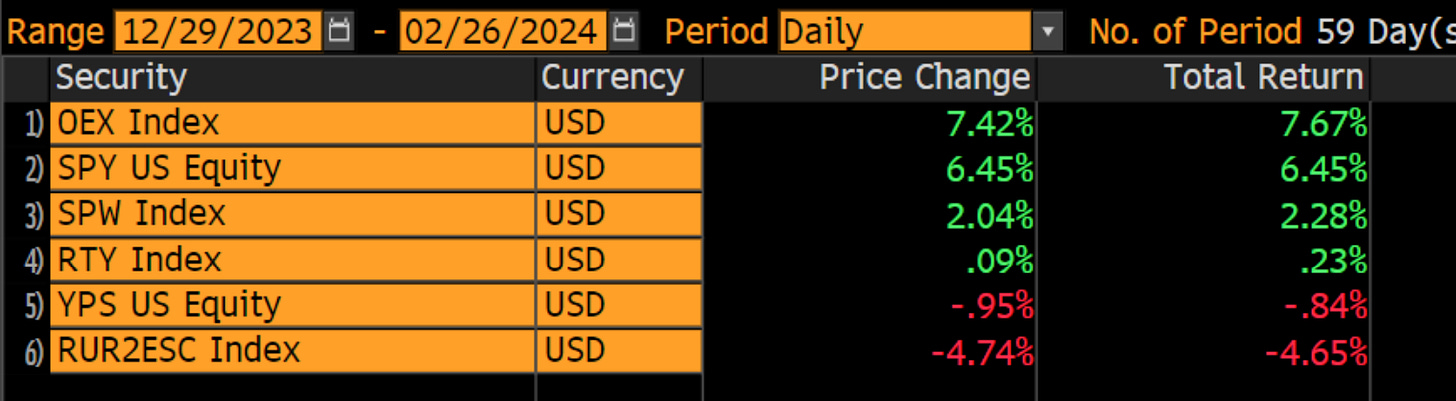

I’m sticking to my argument that the market is getting narrower and narrower and that the key risk lies NOT with the fall in equity values of the mega caps, but with the possible obliteration of levered companies — both public and private. While there are clear signs of froth in the AI world, the median stock remains down fairly meaningfully on the year. Nice work, Jerome. Really got those “financial conditions” pumping.

Last week, I highlighted “the most misunderstood chart in the world” on Twitter:

It turns out that this was definitely a case of “people who live in glass houses should not throw stones.” IThere was an important caveat to this data, which I glossed over. Note the footnote. To avoid liability from unnecessarily crossed eyes, I’ve rewritten it here: